Auto Top-Up Plus

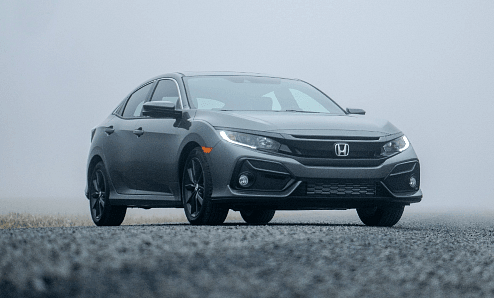

What do you do if your financed vehicle is ever stolen or written off and your vehicle insurance won’t cover the whole outstanding finance amount?

What is Auto Top-Up Plus?

What happens if your car is ever stolen (or written off) and you still owe the bank? That could cost you a lot of ching. That’s why you need Auto Top-Up Plus. This finance shortfall policy pays out the difference between the comprehensive car insurance payout and any amount you still owe on the vehicle. It even includes other benefits like personal accident cover as well as excess and installment protector.

What is covered?

Added benefit – you won’t pay an excess on any Auto Top-Up Plus claims

How does the shortfall cover work?

If your vehicle is either:

- stolen and not recovered; or

- stolen and recovered but damaged and not economical to

repair, and written off; or - accidentally damaged but not economical to repair, and written off and your comprehensive vehicle insurance claim payment result in a shortfall between the claim payment amount and the settlement balance of the credit agreement this policy will cover the shortfall.

How do I qualify for Auto Top-Up Plus cover?

The vehicle must meet the following conditions:

- The vehicle must be insured for total loss cover.

- The vehicle must be financed.

- The underlying policy for the vehicle is insured for its retail value.

Frequently Asked Questions